My paycheck after taxes

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. The IRS is refunding penalties it charged taxpayers for filing their 2019 and 2020 tax returns late as a form of COVID-19 relief.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Next divide this number from the.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. This federal hourly paycheck. Meanwhile the second tax of this type is the Medicare tax.

While your employer typically covers 50 of your FICA taxes this is. Your average tax rate is. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

How Your Tennessee Paycheck Works. On the one hand the first FICA tax is the Social Security tax consisting of a total of 62 of your gross pay. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms.

Also deducted from your paychecks are any pre-tax retirement contributions you make. How do I calculate hourly rate. States you have to pay federal income and FICA taxes.

As is the case in all US. Free salary hourly and more paycheck calculators. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. How Your Pennsylvania Paycheck Works. 8 hours ago Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. That means that your net pay will be 43041 per year or 3587 per month. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld.

It can also be used to help fill steps 3 and 4 of a W-4 form. Taxable income Tax rate based on filing status Tax liability. Your employer withholds a 62 Social Security tax and a.

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Your employer pays an additional 145 the employer part of the Medicare tax. Federal Salary Paycheck Calculator.

Our calculators are easy to use and allow you to punch in numbers and get real results. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. Since our free online calculators arent associated.

Get an accurate picture of the employees gross pay. These taxes are deducted from your paycheck in fixed percentages. The federal government receives 124 of an employees income each pay period for Social Security.

These are contributions that you make before any taxes are withheld from your paycheck. When you dont pay your Oregon property taxes the county can foreclose and get a deed to your home. You can also specify a dollar amount for your employer to withhold.

There is a line on the W-4 that. The refunds dont apply to penalties for failing to. All Services Backed by Tax Guarantee.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

We make taxes just a little easier. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How Your Texas Paycheck Works.

Even if you did a Paycheck. If you are a student present your Social Security CardITIN letter to the UW Registrars Office 2 nd Floor of Schmitz Hall so they can update your student record. Its important to revisit your tax withholding especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year.

Here S How Much Money You Take Home From A 75 000 Salary

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

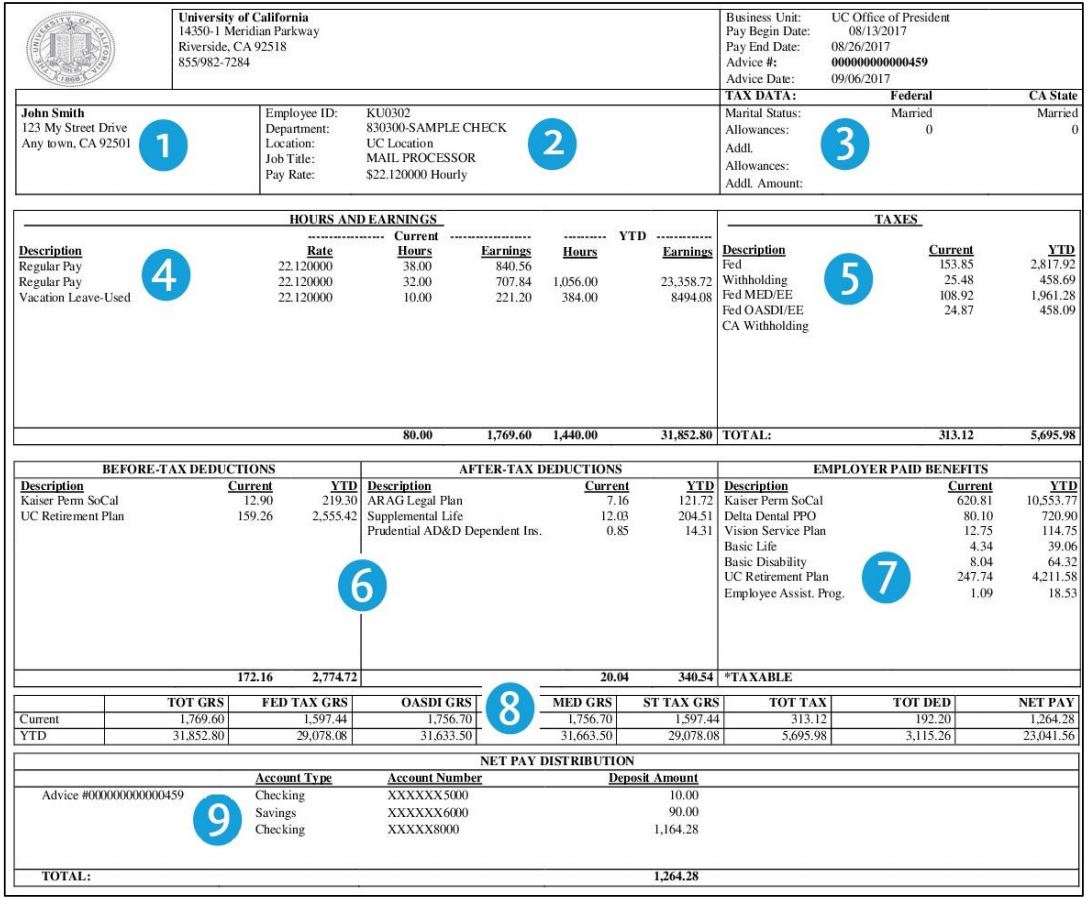

Understanding Your Paycheck

My First Job Or Part Time Work Department Of Taxation

Paycheck Calculator Online For Per Pay Period Create W 4

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Here S How Much Money You Take Home From A 75 000 Salary

Tax Information Career Training Usa Interexchange

Paycheck Taxes Federal State Local Withholding H R Block

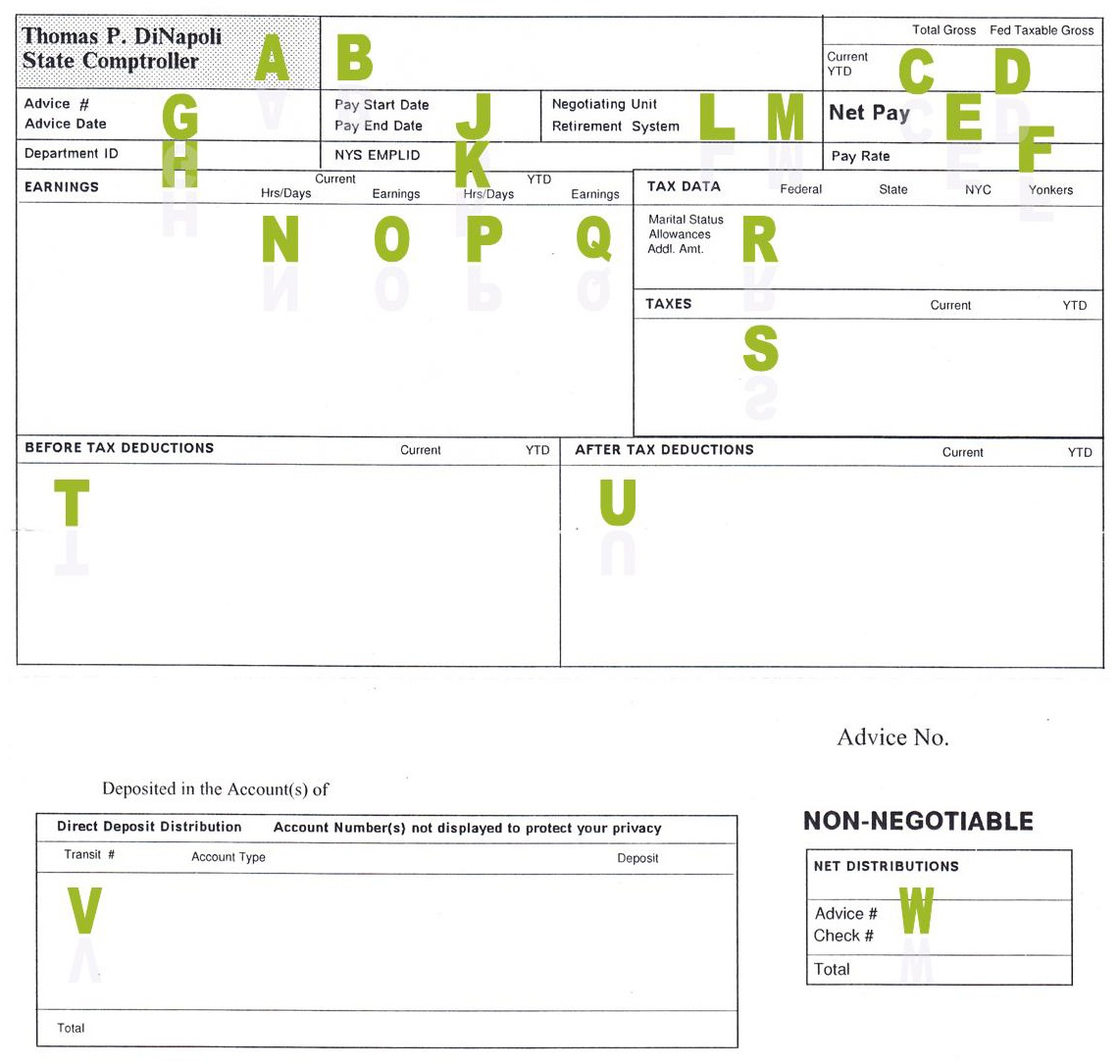

My Paycheck Administrative Services Gateway University At Buffalo

Understanding Your Paycheck Credit Com

New Paycheck Ucpath

Check Your Paycheck News Congressman Daniel Webster

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

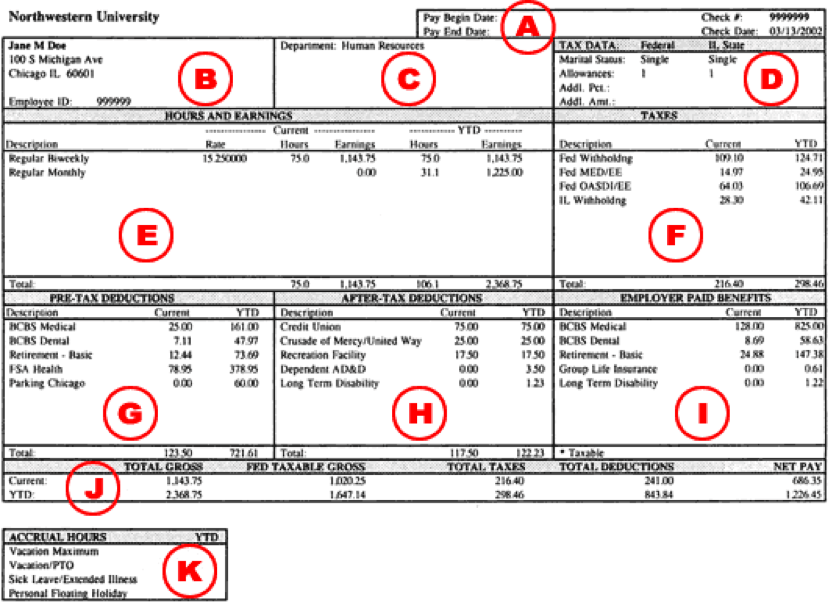

Understanding Your Paycheck Human Resources Northwestern University

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck